- Enterprise AI Executive

- Posts

- What 640 CEOs reveal about AI

What 640 CEOs reveal about AI

Plus, Deloitte tokenomics, CXO decision-making, and more.

Welcome executives and professionals. CEOs are recognizing that AI is more than a technology. It unlocks a fundamentally different way of running organizations, touching strategy, operations, culture, risk, and talent.

Since the previous edition, we have reviewed hundreds of the latest insights in agentic and generative AI, spanning best practices, case studies, market dynamics, and innovations.

This briefing outlines what is driving material value — and why it’s important.

Inside Executive+

Join senior leaders from Microsoft, Walmart, and PwC staying ahead with the extended edition of Enterprise AI Executive.

In today’s briefing:

BCG AI Radar: CEOs take ownership.

How AI’s reshaping CXO decisions.

Deloitte navigates AI spend dynamics.

The State of AI in the Enterprise.

Transformation and technology in the news.

Insights for Executive+ members.

Career opportunities & events.

Read time: 4 minutes.

MARKET INSIGHT

Image source: Boston Consulting Group

Brief: BCG released its AI Radar 2026, surveying 2,360 execs across 16 markets, including 640 CEOs. The report finds AI investment accelerating as CEOs take direct ownership of AI decisions and upskilling.

Breakdown:

Firms will 2x AI spend in 2026 to ~1.7% of revenue. 94% of CEOs remain committed to these levels even if 2026 ROI doesn't materialize.

Half of CEOs believe their roles are at risk if AI fails, yet 82% are more optimistic about AI’s return on investment than last year.

72% of CEOs now act as primary AI decision makers, with "trailblazing" CEOs spending 8 hours/week on their own AI upskilling.

AI trailblazers are directing over half of 2026 AI budgets to agents and are twice as likely as "followers" to deploy agents end to end.

Western CEOs more often cite investing in AI to avoid falling behind, while Eastern peers invest because they're confident it will pay off.

Why it’s important: True advantage lies with CEOs who reshape functions end-to-end and invent new offerings for growth. With 90% of CEOs saying enterprise success by 2028 will be heavily tilted towards firms that get AI right, corporate leadership is being redefined.

EXECUTIVE DECISION-MAKING

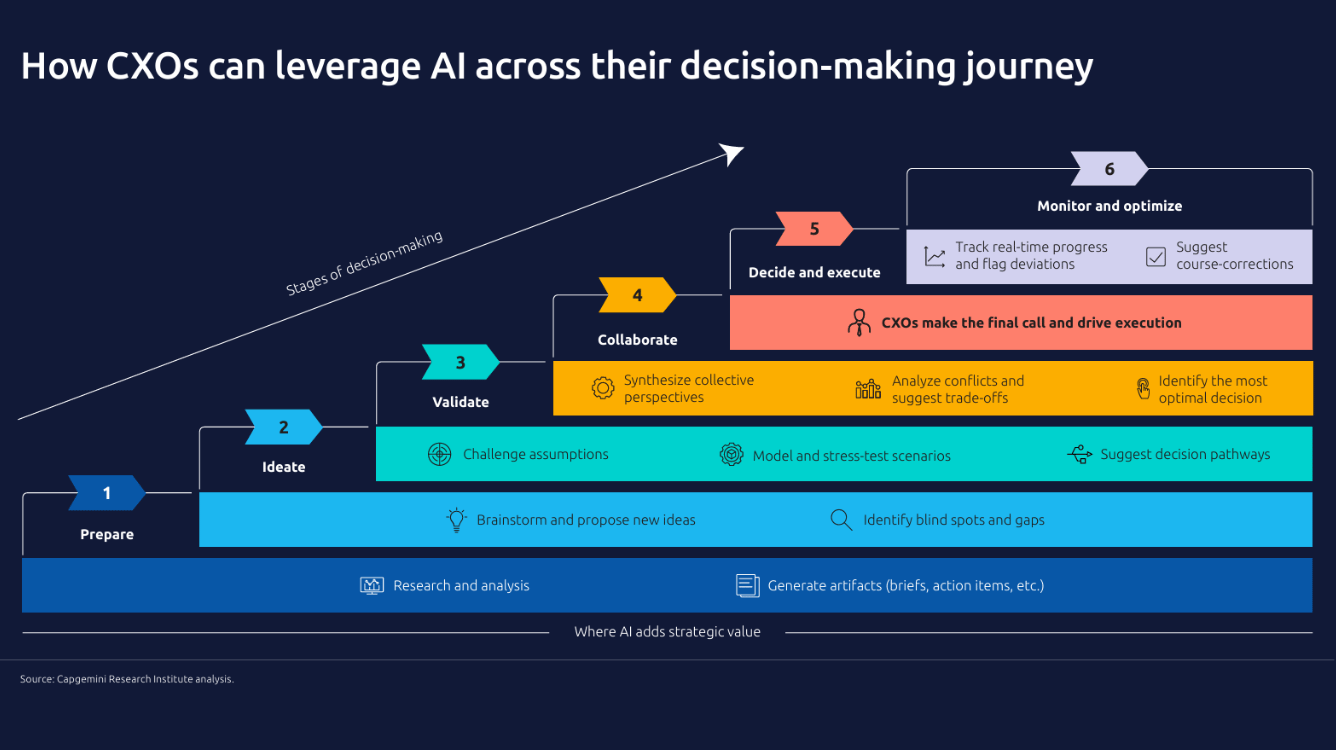

Image source: Capgemini Research Institute

Brief: Capgemini Research Institute examined how CXOs integrate AI into strategic decision-making, drawing on a survey of 500 CXOs, including 100 CEOs, alongside in-depth interviews.

Breakdown:

CXOs mainly use AI for research, analysis, and summarization today, but expect it to increasingly augment strategic thinking within three years.

17% of CXOs "actively" use AI in strategic decisions today, a figure expected to rise to 38% over the next one to three years.

44% of CXOs use it "selectively" but not as a consistent practice, with adoption expected to grow to 51% within the next one to three years.

Most organizations lack clear AI governance frameworks, leaving many CXOs cautious and reluctant to openly disclose AI usage.

58% of CXOs see a significant gap between AI’s potential and actual use in group settings, while only 28% report this gap in individual use.

Why it’s important: C-suite decision-making is evolving as leaders navigate growing data complexity, the need for agility, and pressure for evidence-based choices. With AI emerging as a key enabler, the report includes actions firms can take to help make AI-powered decisions with confidence.

ENTERPRISE AI ECONOMICS

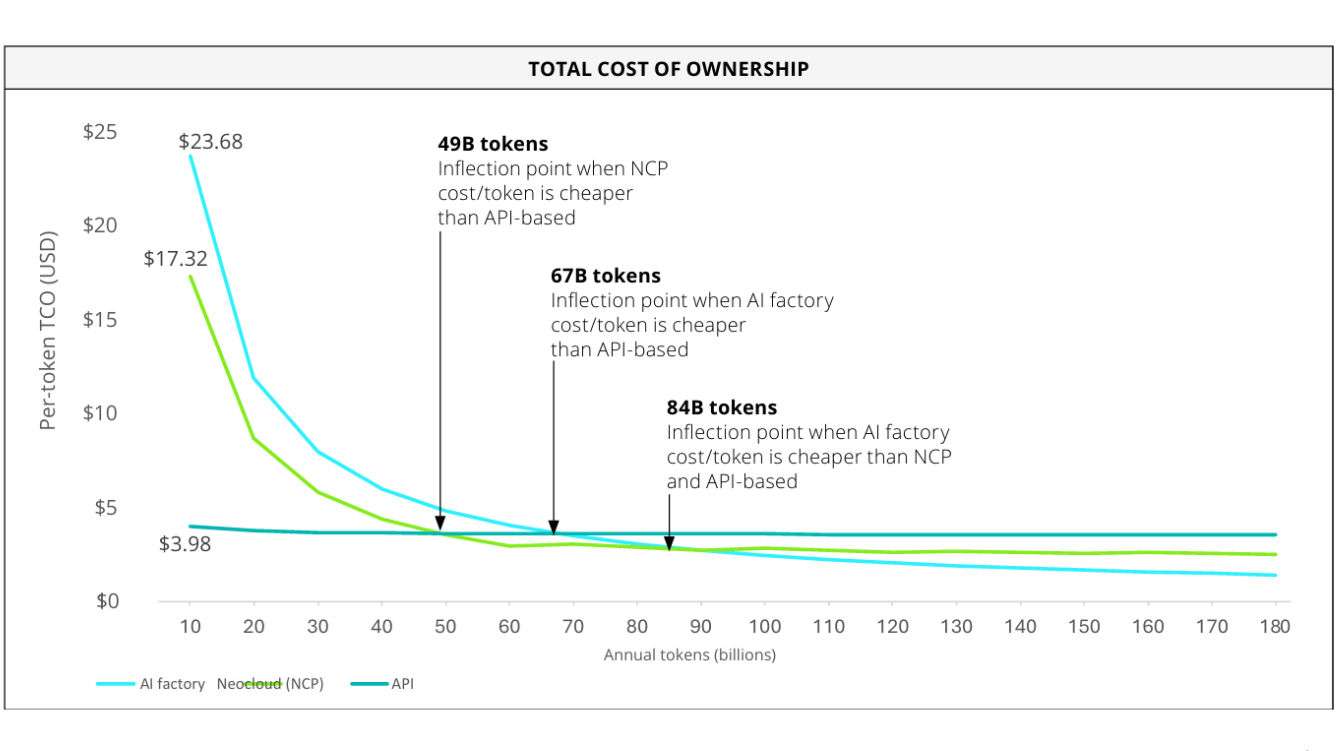

Image source: Deloitte simulation

Brief: Deloitte released a 28-page report on AI economics, exploring what tokens are, how different agentic models shape pricing, and strategies enterprises can use to optimize token use for maximum competitiveness.

Breakdown:

Tokens are the currency of AI economics, as vital as kilowatt hours are to electricity, yet harder to predict, making AI spend volatile.

AI costs appear as SaaS line items, metered API usage, or owned infra AI factories balancing GPUs, storage, networks, and energy.

Smaller, less predictable workloads may remain API-based, while scaled, high-value workloads shift to AI factories as economics stabilize.

The report provides TCO modeling and scenario analysis to show how AI costs scale and where cost inflection points emerge.

At 84B+ tokens annually, AI factories offer the lowest TCO. API costs scale linearly, while Neocloud hinges on GPU use (image above).

Why it’s important: AI has become the fastest-growing line item in enterprise IT budgets, consuming up to half of total spend at some firms. At the same time, rising sovereignty pressures and infrastructure control elevates token economics from an IT concern to a board-level issue for CFOs and investors.

MARKET INSIGHT

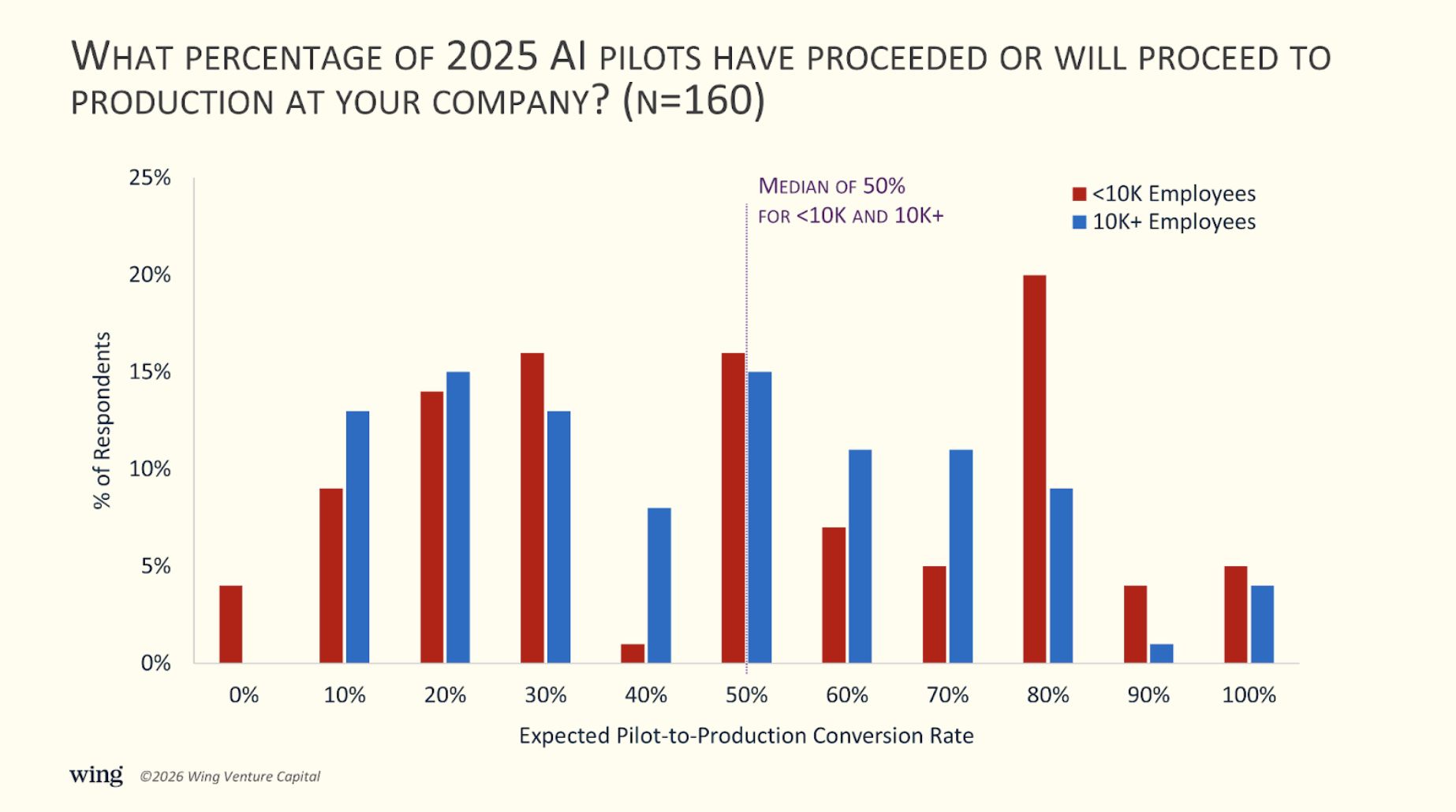

Image source: Wing Venture Capital

Brief: Wing Venture Capital published its inaugural State of AI in the Enterprise, based on direct input from 181 chief-level AI leaders. All respondents were C-suite, with 52% from large enterprises (10,000+ employees).

Breakdown:

Among large enterprises, a median 50% expect AI pilots to reach production, with 41% at 10–30% and 38% forecasting 50–70%.

56% of large enterprises report AI agents in early or large-scale production (32% running one or more use cases; 24% two or more).

OpenAI leads large-enterprise AI workloads, ranked #1 by 61% of firms, followed by Gemini at 17% and Anthropic at 11%.

66% of large enterprises expect that teams impacted by AI will experience headcount reductions of 10-25% in 2026.

Wing’s C-level data is notably more positive (and much more detailed) than the widely publicized MIT Project NANDA study.

Why it’s important: Wing’s report cuts through AI hype to reveal which enterprise deployments are moving beyond pilots, what’s stalling in the path to production, and how the platform landscape is forming within enterprise workloads, framing AI as a 10–20 year supercycle still in its early innings.

Deloitte outlined how a human-led, AI-powered future depends on cultivating capabilities technology cannot replace as a lasting differentiator.

Capgemini published a 71-page report surveying 1,500 leaders in 15 countries, showing AI budgets rising with sovereignty and trust as priorities.

Anthropic shared guidance on evaluating AI agents, covering why evals matter, how to run them, core components, and a roadmap for success.

Cognizant’s 36-page AI and jobs report shows workforce disruption is more extensive and faster than anticipated three years ago.

McKinsey CEO Bob Sternfels said the firm now has 60,000 workers, including 25,000 AI agents, and shared lessons on AI-era leadership.

Menlo Ventures argued the SaaS playbook fails in AI, describing proto-markets where products are never “done” and unit economics remain unsettled.

Microsoft’s ‘Community-First AI Infrastructure’ pledges no power cost hikes, water replenishment, and local job investment.

Anthropic cut xAI’s Claude access after finding the AI lab used the models via Cursor to accelerate internal development.

OpenAI announced a deal with Cerebras to deploy 750MW of dedicated compute with capacity rolling out through 2028.

Google launched Universal Commerce Protocol, an open framework enabling AI agents to manage integrated shopping with retailers.

IBM launched Sovereign Core, enabling sovereign AI environments with full control over data and governance, with GA planned for 2026.

Alibaba Qwen head Justin Lin said Chinese AI firms have under a 20% chance of overtaking U.S. frontier models in 3–5 years, citing resource gaps.

Executive+ members receive the extended edition of Enterprise AI Executive each week: Further AI transformation and technology coverage, plus executive insights beyond AI.

Your membership also supports the Enterprise AI Executive mission, helping to sustain research quality and consistency.

CAREER OPPORTUNITIES

Unilever - Head of Commercial AI

AstraZeneca - Enterprise AI Executive Director

WPP - AI Center of Excellence Lead

EVENTS

Cognizant - AI-First Enterprise - January 22, 2026

Cisco - AI Summit - February 3, 2026

PwC - Geopolitics & AI Risk - February 17, 2026

Originally conceived as a practical communication for executives the editor, Lewis Walker, has worked with, this briefing now serves as a trusted resource for thousands of senior decision-makers shaping the future of enterprise AI.

If your AI product or service adds value to this audience, contact us for information on a limited number of sponsorship opportunities.

We also welcome feedback as we continue to refine the briefing.